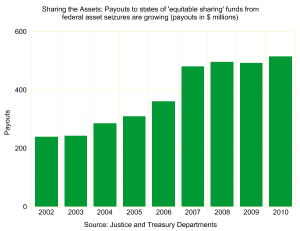

As so many of you know, few landlords are willing to rent to marijuana businesses. They are afraid of the very real possibility of losing their property in a federal civil asset forfeiture action. The federal government has been known to seize property being used for cultivating, manufacturing, or selling marijuana. In the last seven years, the Feds have seized more than a billion dollars in personal and real property allegedly tied to federally illegal drugs, including marijuana in states where marijuana is legal.

If you are a landlord or a marijuana business tenant, you should know what you can do to help avoid federal intervention, including asset forfeiture.

Under federal law, forfeitures can be civil or criminal:

The following shall be subject to forfeiture to the United States and no property right shall exist in them … [a]ll real property, including any right, title, and interest (including any leasehold interest) in the whole of any lot or tract of land and any appurtenances or improvements, which is used, or intended to be used, in any manner or part, to commit, or to facilitate the commission of, a violation of this subchapter punishable by more than one year’s imprisonment.

Since manufacturing, cultivating, and distributing cannabis are federal crimes, real property that facilitates those crimes is subject to asset forfeiture.

Civil forfeitures of real property are brought as judicial forfeiture actions that require a court to oversee the seizure. In these civil cases, the government has the burden of proving that the property is subject to forfeiture. The government does not need to prove the landowner is guilty of a crime. It merely needs to show a “substantial connection” between the property and the crime.

Federal law does provide what is known an “innocent owner defense” to the forfeiture of real property. This defense provides that property will not be forfeited if the owner can show that it did not know about the conduct giving rise to forfeiture or that when it learned of the conduct giving rise to the forfeiture it did all that it reasonably could to terminate such use of the property.

Here’s the big problem though in states where marijuana is legal for either medical or recreational use. In those states, the innocent owner defense is usually not available because the state typically mandates that the lease explicitly allow for the growing, manufacturing, or selling of marijuana. And, in most marijuana-legal states, having a lease that allows for marijuana activity is also required to receive a state license to operate.

There are though many things that both landlords and tenants can to prevent asset forfeiture or federal intervention altogether, including those discussed below.

Real property leases that involve a cannabis business should include “escape clauses” that specifically list out federal intervention, changes in federal enforcement policy, forfeiture threats, and federal enforcement actions (such as DEA raids or DOJ criminal charges or administrative actions) as defaults that constitute lease violations. This sort of provision will give the landlord fodder for appeasing the Feds.

Commercial leases typically contain a permitted use provision governing the activities permitted on the leased property. The permitted use provision for a cannabis business should specifically identify the activities allowed on the property. If the tenant is a marijuana retailer, the permitted use provision should explicitly permit “retail sale of marijuana.” Leaving the permitted use vague will likely mean that marijuana tenants run the risk of breaching the lease by conducting an activity not permitted on the property, which itself could invite federal scrutiny.

Marijuana commercial leaseholds should provide for a strict code of conduct for property use. The typical Commercial Broker’s Association lease states that any illegal activity on the property will constitute a default in the lease, so just pulling one of these provisions “off the shelf” is not appropriate. We typically write our commercial marijuana leases to forbid only those actions that violate state law — not federal law.

Your marijuana lease should also include provisions relating to hours of operation, how the tenant treats of its neighbors, odors, loitering, use of hazardous substances, the number of people permitted on the property, and compliance with state and local regulatory rules and with the Cole Memo.

Federal marijuana prohibition coupled with the fluidity of state marijuana regulatory schemes make standard commercial lease agreements wrong for leases involving marijuana businesses. You instead need a lease that deals with the realities of running a marijuana business.