As veteran marijuana business owners (and virtually every other type of industry owners) know, there may come a point in time in the business when you are sitting across the table from someone who is offering to put money into your business. They may be your prospective business partner. They may be your close friends or family members. They may be friends of friends. They may be a private equity group, angel investors, or venture capitalists. Many of your closest family and friends have been close to you during your business growth. The ones who trust you because they have a close personal connection probably will not ask too many prying questions because they are investing in your strength, tenacity, and vision, not primarily in the strength of your business prospects. There are several right ways and many wrong ways to accept money from outside financiers for your business, but this post is not about how to do a securities offering the right way. (See here for some prior posts on that topic.) This post is about preparing yourself as the business owner for the types of questions you should expect to receive when you are discussing your business with potential investors.

All savvy investors are savvy because they are experienced. When we are feeling especially erudite, we may call them “sophisticated investors.” We call investors with a lot of assets “accredited investors,” which does not necessarily mean they are sophisticated, though many are. While sophisticated investors will not know everything about every product in every business market, they know the fundamentals of a good business. Many investors, especially in the venture capital and private equity world, have owned businesses. And they will be able to determine whether your cannabis business venture is worth investing in, regardless of whether you are primarily involved in cultivation, processing, manufacturing, R&D, distributing, or selling retail marijuana products. Prospective investors are literally everywhere: in your community, in your state, and in larger national and international markets. The U.S. has been and will continue to be the safest place to earn a good return without introducing unnecessary risks. Prospective investors are looking for a good return in a good business, and yours may be it, depending on how well you address the types of concerns below.

1. Does Your Management Team Know What They Are Doing?

Sophisticated investors are really not that different from your parents or grandparents. Your family and friends believe in you and invest in your business because they know you. Your prospective investors who do not know you need to understand both the human side of you and your business acumen. If you convince them that you know your market, your niche within that market, and that you are committed to doing what you know or can reasonably develop through talent acquisition, they will trust that you will take care of their money as if they were your family or friend. This is the ultimate test of your fiduciary duties to your investors – proving that you can keep both the duty of care (make sound business judgments) and the duty of loyalty (put the business’ interest above your own). Your temperament will also matter. If you are a jerk to work with and they can sense that, it may not kill the investment opportunity, but it might.

2. Do You Understand the Financials of Your Business?

This is not a legal issue, but it is an extremely important issue because your investors are probably well versed in business finance. If your bookkeeping skills are atrocious because you are a DIY kind of person or your bookkeeper does not have good organizational skills; if your financial statements are incomplete, inaccurate, or just plain wrong; or if your Quickbooks accounts have not been closed out every month, no sophisticated investor will touch your business until you get it all cleaned up. Why not? Your financials are the easiest way for someone to understand your business at a glance.

If your financial inputs are sloppy, then your outputs are unreliable, giving your prospective investors no real metrics to compare your business to other businesses they have invested in or are considering. If you do not have good financial statements, there is zero chance that you really understand your market or can plan for future growth because you also have no good data from which to base your business decisions. You need to know your key business metrics (KPIs = key performance indicators) so you can explain to your potential investors exactly what great things you want to accomplish with their investment in your company. If you just need money because “cash flow is tight”, you will walk away with zero investment dollars.

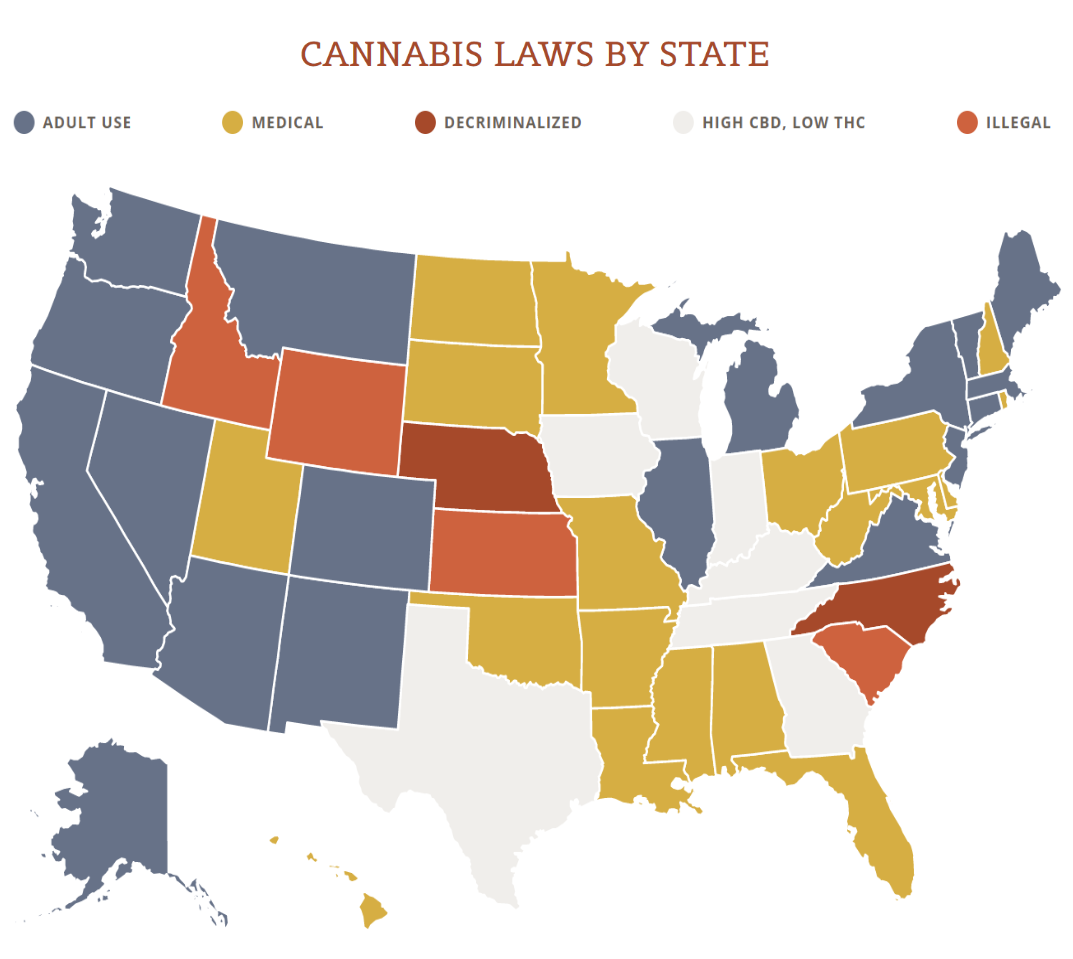

View the US Map of Marijuana Legality

3. Do You Understand Your Business Risks?

Your prospective investors will want to know that you are aware of your business risks. Do not shy away from giving your cold-blooded appraisal of your business, your employees, your business partners, your products, your weaknesses, and your acknowledgment that even though you believe in your company and will work relentlessly, success is never certain. Litigation lawyers love undisclosed or underrated risks, uncertainty, and ambiguity in investment relationships and contracts because this environment creates a cornucopia of ways for them to sue your company on behalf of your disgruntled investor, even if they are (were) your close friends.

Good transaction or “deal” lawyers want to make sure you think through every possible risk of your cannabis business before you start hinting to anyone that you might want to take on investors. You need to learn to think like a paranoid lawyer who sees risks everywhere. Remember that not all risks are created equal. A great transaction lawyer will help you see your risks, evaluate them, and weigh them according to their relative likelihood to arise in your business.

4. Do You Have Your Owner Relationships Soundly Grounded in a Written Contract?

One of the worst things you can do is start a business and never get around to putting key relationships in writing. I see this way too often in the cannabis world in businesses with two or more partners. Either everything was done on a handshake or the operating agreement or shareholder agreement is not good, does not reflect reality, or is just plain wrong.

Recently, I reviewed a contract for some LLC owners who used an agreement intended for a partnership. That was a huge problem because it gave all of the LLC owners equal rights, which is appropriate in some scenarios but not in others. That is one of the reasons why today we almost never form partnerships but instead use LLCs and other vehicles. Get your ownership agreements in place and discuss the difficult “what if” scenarios now during your business honeymoon phase. If prospective investors catch wind that you and your business partners are not in sync on all issues, they will not be willing to invest.

Take heart that very few businesses who are preparing to take on investors have everything in perfect form. As business owners you always have two or three or ten times more things to do than you have time to do, even if you have trusted and competent people working with you in your business. The best thing you can do is keep a running list of potential due diligence items (see here and here) and work through your list with competent professionals.