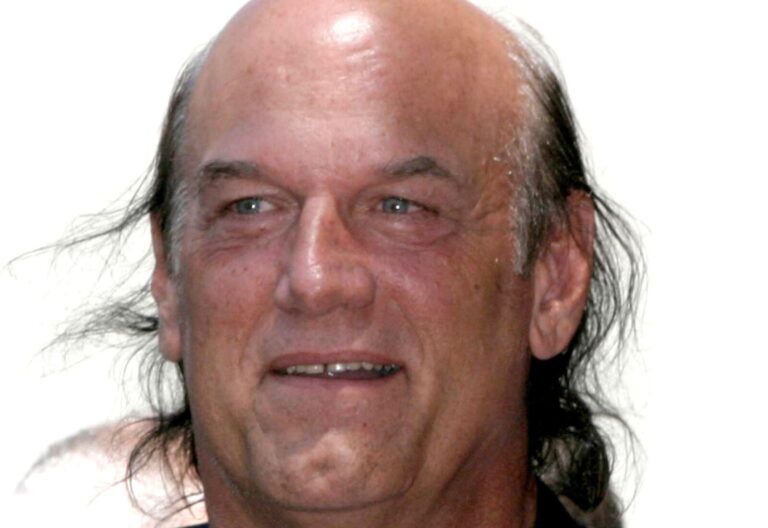

Former Minnesota Governor Jesse Ventura Starts Cannabis Brand

Former Minnesota Governor and ex-professional wrestler Jesse Ventura is the latest celebrity to start a cannabis brand. Ventura served as Governor of the Land of 10,000 Lakes from 1999 to 2003. One could say that no other Governor serving during the late ’90’s or early 2000’s had quite the extensive background in variously different forms